COVID-19

Everything You Need to Know About COVID-19 to Keep You and Your Company Safe on the Road.

FMCSA Announces Extensions of the COVID-19 Emergency Waivers and Declarations

FMCSA announced extensions of some COVID-19 Emergency Waivers and Declarations that were set to expire at the end of February.

EMERGENCY DECLARATION

FMCSA’s Emergency Declaration that was set to expire on February 28th has been extended until May 31, 2022.

The declaration extended yesterday is limited to the transportation of:

- Livestock and livestock feed;

- Medical supplies and equipment related to the testing, diagnosis, and treatment of COVID-19;

- Vaccines, constituent products, and medical supplies and equipment, including ancillary supplies/kits for the administration of vaccines, related to the prevention of COVID-19;

- Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap, and disinfectants;

- Food, paper products, and other groceries for emergency restocking of distribution centers or stores;

- Gasoline, diesel, jet fuel, and ethyl alcohol; and,

- Supplies to assist individuals impacted by the consequences of the COVID-19 pandemic (e.g., building materials for individuals displaced or otherwise impacted as a result of the emergency).

As with the previous extension, this declaration applies only to 395.3 “Maximum Driving Time for Property-Carrying Vehicles”. This declaration becomes effective at 12:00 a.m. March 1, 2022 and expires May 31, 2022 unless modified or terminated sooner. Reporting requirements previously established remain in effect. To be eligible, the transportation must be both (1) of qualifying commodities and (2) incident to the immediate restoration of those essential supplies. We strongly encourage everyone to review the applicability, restrictions, and limitations listed within the waiver.

CDL/CLP/MEDICAL EXAMINATION ENFORCEMENT DISCRETION

FMCSA has issued a notice of enforcement policy/discretion regarding CDL/CLPs and Medical Examinations. FMCSA will exercise its enforcement discretion to not take enforcement action for a CLP or CDL holder operating a CMV with an expired license, but only if the CLP or CDL was valid on February 29, 2020 and expired on or after March 1, 2020. FMCSA will also exercise enforcement discretion for CMV drivers whose medial certification or medical variance expired on or after December 1, 2021. Drivers whose medical certification or medical variance expired before December 1, 2021 are not covered by this notice of enforcement policy.

This notice is effective March 1, 2022 and expires on April 15, 2022.

ADDITIONAL NOTICES AND RESOURCES

FMCSA has extended existing waivers related to CLP holders, out of state skills testing, and the 14 day waiting period here. Additional resources, including frequently asked questions can be found here.

FMCSA Announces Several Extensions of the COVID-19 Emergency Waivers and Declarations

This morning, FMCSA announced several extensions of the COVID-19 Emergency Waivers and Declarations.

EMERGENCY DECLARATION

FMCSA’s Emergency Declaration that was set to expire on November 30th has been extended until February 28, 2022.

The declaration published today is limited to the transportation of:

- Livestock and livestock feed;

- Medical supplies and equipment related to the testing, diagnosis, and treatment of COVID-19;

- Vaccines, constituent products, and medical supplies and equipment, including ancillary supplies/kits for the administration of vaccines, related to the prevention of COVID-19;

- Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap, and disinfectants; and,

- Food, paper products, and other groceries for emergency restocking of distribution centers or stores;

- Gasoline, diesel, jet fuel, and ethyl alcohol; and,

- Supplies to assist individuals impacted by the consequences of the COVID-19 pandemic (e.g., building materials for individuals displaced or otherwise impacted as a result of the emergency).

This declaration applies only to 395.3 “Maximum Driving Time for Property-Carrying Vehicles”. This declaration becomes effective at 12:00 a.m. December 1, 2021 and expires February 28, 2022 unless modified or terminated sooner. Reporting requirements previously established remain in effect. To be eligible, the transportation must be both (1) of qualifying commodities and (2) incident to the immediate restoration of those essential supplies. We strongly encourage everyone to review the applicability, restrictions, and limitations listed within the waiver.

CDL/CLP/MEDICAL EXAMINATION EXTENSIONS

FMCSA has extended the CDL and CLP waivers under certain circumstances. Details on the applicability can be found here. Please note, this waiver permits, but does not require,States to extend the validity of commercial driver’s licenses (CDLs) and commercial learner’s permits (CLP) for those issued on or after March 1, 2020, until February 28, 2022. Carriers and drivers should check with their state agencies to ensure compliance, as not all states may extend the validity period.

For medical examinations, this waiver waives, until February 28, 2022, the requirement that drivers have a medical examination and certification, provided they have proof of a valid medical certification and any required medical variance issued for a period of 90 days or longer and expired on or after September 1, 2021. Additional terms, conditions, and restrictions are outlined in the waiver.

THIRD-PARTY CDL TESTING AND CLP HOLDERS

Additionally, FMCSA has extended waivers related to third-party CDL skills test examiners, and CLP holders operating a CMV.

Additional resources, including frequently asked questions can be found here. FMCSA has indicated they intend to review the status of certain waivers as of January 3, 2022 and may take action to terminate the waivers sooner if conditions warrant.

American Trucking Associations Issues Statement on COVID-19 Vaccine Mandate

On October 21, 2021, Chris Spear, President & CEO at the American Trucking Associations, issued the following letter regarding the COVID-19 vaccine mandate and provided a toolkit to help address frequently asked questions:

|

Dear ATA Member: I wanted to update you on the latest developments regarding the Administration’s vaccine mandate proposal, as well provide relevant resources to help your companies navigate this issue. Since OSHA sent its proposed rule—which has not yet been made public—to the White House on October 12, we have been in constant communication with Administration officials to convey our serious concerns over the impact such a policy will have on the trucking industry and our ability to keep the nation’s supply lines moving. This evening, we submitted official comments to the Office of Information and Regulatory Affairs—the White House office responsible for reviewing the draft Emergency Temporary Standard before it can go into effect. Our letter formally requests that the Administration:

Thanks to data provided by ATA members, we have detailed the grave consequences that a misguided rule would have on our nation’s supply chain, which is already under enormous strain. We have made clear that our industry can ill-afford further disruptions as we carry out the vital work of delivering vaccines, PPE, medical supplies, food, water, gasoline, and other essential goods. It bears repeating that no rule—draft or otherwise—has been made public to date. Although we hope the Administration heeds our concerns, we are prepared to respond to every possible outcome, with all options on the table, including potential legal action if necessary. In the meantime, we have prepared this toolkit, including frequently asked questions, to help you and your employees better understand what is undoubtedly a complex topic and complicated rulemaking process. We will keep you updated with additional developments. Best, Chris |

FMCSA Announces Remote Carrier Audit Option During COVID-19

During the COVID-19 public health emergency, the Federal Motor Carrier Safety Administration (FMCSA) has announced it will conduct compliance reviews under 49 CFR part 385, subpart A, by leveraging all available technology to access information and records and thus limit exposure risk for the regulated community and safety investigators. Using the same standards otherwise applicable, FMCSA will assign safety ratings following a compliance review even if no on-site review activities have taken place. FMCSA will continue to apply the procedures in 49 CFR part 385, including the Safety Fitness Rating Methodology (SFRM) in Appendix B, prior to assigning a safety rating. This guidance does not apply to compliance reviews conducted under 49 CFR part 385, subpart B.

Since adoption of the SFRM in 1997, the mechanisms and tools FMCSA use to access information from motor carriers has continued to evolve, making compliance reviews more efficient and lessening the burden on the regulated community. Although the definition of “compliance review” in 49 CFR 385.3 describes these reviews as “on-site,” in practice, the advent of electronic recordkeeping and other technology now allows FMCSA to perform the same investigative functions remotely that it could perform previously only by in-person reviews of the motor carrier’s files.

Motor carriers may access and transmit their information through a portal directly with FMCSA and upload documents in a secure environment. Many motor carriers maintain their records electronically and prefer to submit the records directly, from the electronic application where they are stored. Motor carriers may also fax or email documents to FMCSA if they so choose, or if they cannot access the portal. FMCSA may also use email and telephone and video calls as a substitute for in-person interaction with motor carrier officials during the compliance review or to review the findings of the compliance review with company officials during the close out.

Because of travel restrictions, social distancing, and other advisories associated with the COVID- 19 public health emergency, and the desire to limit exposure risk to the regulated community and safety investigators, FMCSA will conduct compliance reviews of motor carriers and assign safety ratings even if those compliance reviews do not include an “on-site” component. FMCSA has determined that because safety investigators are able to follow all of the procedures in 49 CFR part 385 without physically visiting the motor carrier’s business premise, compliance reviews that do not include an “on-site” component will limit exposure risk to COVID-19, consistent with current regulations, without compromising FMCSA’s safety mission.

This guidance is effective immediately and shall remain in effect until the COVID-19 National Emergency Declaration is lifted.

FMCSA Extends Emergency Declaration to June 14

The Federal Motor Carrier Safety Administration has announced they are extending their Emergency Declaration for regulations, including Hours of Service, until June 14, 2020. The declaration provides regulatory relief for carriers assisting in emergency relief/resupply efforts in response to the COVID-19 outbreak. The previous declaration was set to expire this Friday, May 15. CLICK HERE for a copy of the extension.

PPP Deadline Extended; Discussions on PPP Expansion in DC

The Small Business Administration has announced that the deadline for applying for the Paycheck Protection Program has been extended from May 7 to May 14. If you still want to apply for the PPP, please contact your local SBA-approved lender.

In addition, lawmakers in Washington, DC are discussing future expansions of the PPP as the House and Senate are working on the next stimulus package. The House is expected to unveil plans as early as Friday. Stay tuned.

Ohio Issues "Stay Safe Ohio Order"

‘Stay Safe Ohio’ order extends some stay-at-home protocol until May 29, with exceptions for reopening. CLICK HERE to read the full order.

PPE Resources

Hand Sanitizer

Middle West Spirits in Columbus is providing hand sanitizer ranging from 8oz bottles to a 5 gallon bucket with spout. The 5 gallon buckets are $0.25 an ounce. To order please do so directly use this form.

Drivers are also able to stop at Jet Express in Dayton to fill up their personal supply of hand sanitizer. Jet Express is located at 4518 Webster Street, Dayton, OH, 45414.

Disposable Masks

If you are looking for FDA Certified Medical 3-Layer Disposable Masks, they are available through Aunt Flow, a Columbus based company. Prices are as low as $0.96 each. Please order by following this link.

Cloth Masks

Delta Apparel, a Hebron based company, has non-medical grade cloth face masks available for as low as $1.15 per mask. CLICK HERE for more information and ordering information.

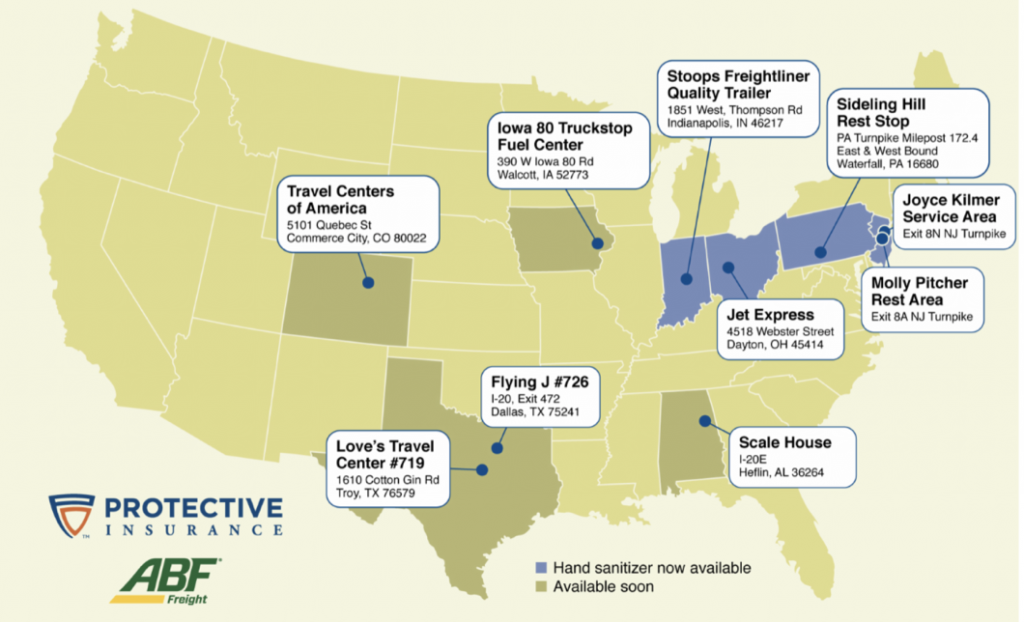

OTA Members Support ATA Distribution of Hand Sanitizer

As professional truck drivers continue serving on the frontlines during the COVID-19 crisis, American Trucking Associations has partnered with Protective Insurance Company to expand the availability and supply of hand sanitizer to truckers along major U.S. freight corridors. ATA and member-company ABF Freight are hauling ten 55-gallon drums of hand sanitizer, purchased by Protective Insurance, for distribution in eight states, where drivers will be able to refill their personal supplies at no cost.

As professional truck drivers continue serving on the frontlines during the COVID-19 crisis, American Trucking Associations has partnered with Protective Insurance Company to expand the availability and supply of hand sanitizer to truckers along major U.S. freight corridors. ATA and member-company ABF Freight are hauling ten 55-gallon drums of hand sanitizer, purchased by Protective Insurance, for distribution in eight states, where drivers will be able to refill their personal supplies at no cost.

Ohio BMV Clarifies CDL Hazmat Renewal Process During COVID-19

The continued social distancing requirements and facility closures stemming from the COVID-19 pandemic has caused some confusion and uncertainty in one key area: the process for renewing a hazardous materials (hazmat) endorsement on a Commercial Driver’s License (CDL), which includes the successful completion of a Security Threat Assessment (STA) from the Transportation Security Administration (TSA).

After reaching out to the Ohio Bureau of Motor Vehicles (BMV) for clarification, the following guidance is in place for Ohio CDL drivers with a hazmat endorsement. OTA members, login to the members only portal for the full guidance.

BWC Board approves $1.6 billion dividend for Ohio employers

The Ohio Bureau of Workers' Compensation’s Board of Directors approved to send up to $1.6 billion to Ohio employers this spring to ease the economic impact of the coronavirus (COVID-19) pandemic on Ohio’s economy and business community. This action comes in response to Ohio Governor Mike DeWine’s call for state agencies to do all they can to help the state’s business community withstand COVID-19’s challenges, which include temporary business closings, stay-at-home orders, and a record number of Ohioans applying for unemployment assistance. CLICK HERE for a FAQ Document.

TSA extends renewal time for TWIC cards to July 31, 2020

The Transportation Security Administration (TSA) has granted a temporary exemption for the expiration of Transportation Worker Identification Credentials (TWIC) through July 31, 2020 for cards that expired after March 1, due to continued gathering restrictions and facility closures stemming from the COVID-19 nationwide emergency.

The exemption became effective April 10.

“During this time, it is vital to move cargo expeditiously through the supply chain, and to ensure that medical supplies and home goods reach health care centers and consumers,” said the TSA announcement.

TSA regulations require truck drivers and other transportation workers who seek unescorted access to secured areas of maritime port facilities to undergo a security threat assessment conducted by the agency to receive a TWIC.

A TWIC expires five years from the date of issuance, and individuals must go to a TSA enrollment center to initiate a new security threat assessment to receive a new credential.

TWIC applicants also are required to provide proof of identity and fingerprints at approved enrollment sites, designated and operated by TSA trusted agents.

TSA records show that 234,536, or approximately 10% of the total number of TWICs issued, will expire in the next six months.

“Social distancing practices in response to the COVID-19 crisis make gathering at enrollment centers unwise or prohibited,” TSA said. Approximately one-third of TSA’s TWIC enrollment centers have been forced to close because they are collocated with commercial or government offices that are closed as a result of COVID-19. For those that are operating, the process of collecting fingerprints and completing the enrollment process “may introduce risk to enrollment center staff or TWIC applicants,” TSA said.

During the extension period, the agency said it will continue to recurrently vet exempted TWIC holders against federal terrorism and national security-related watch lists, and a Department of Homeland Security system for security threats, criminal history and immigration status checks.

No Extension of IFTA Filing Deadline

We Appreciate You and Your Dedication to the Industry!

Ohio's Stay-At-Home Order Extended

Ohio's stay-at-home order will now run through the entire month of April at least – with additional limitations – after Gov. Mike DeWine announced an extension Thursday, April 2, 2020. The extension serves as a response to the continued growth of coronavirus cases in the state amid the ongoing pandemic. Full Order HERE.

Latest FMCSA and DOT Information and Releases

- Three Month Waiver for States and CLP Holders Operating Commercial Vehicles

- Enforcement Notice on Expiring CDLs- Effective March 24

- Waiver for States, CDL Holders, CLP Holders and Interstate Drivers Operating Commercial Motor Vehicles

- DOT Guidance on Compliance with DOT Drug and Alcohol Testing Regulations

- Frequently Asked Questions Relating to FMCSA Declaration

- PHMSA Notice of Enforcement Policy Regarding Hazardous Materials Training

US DOT Expands National Emergency Declaration for Commercial Vehicles Delivering Relief in Response to the Coronavirus Outbreak

The U.S. Department of Transportation’s Federal Motor Carrier Safety Administration (FMCSA) today issued an expanded national emergency declaration to provide hours-of-service regulatory relief to commercial vehicle drivers transporting emergency relief in response to the nationwide coronavirus (COVID-19) outbreak.

FMCSA’s expanded declaration provides for regulatory relief for commercial motor vehicle operations providing direct assistance supporting emergency relief efforts intended to meet immediate needs for:

▪ Medical supplies and equipment related to the testing, diagnosis and treatment of COVID-19.

▪ Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap and disinfectants.

▪ Food, paper products and other groceries for emergency restocking of distribution centers or stores.

▪ Immediate precursor raw materials—such as paper, plastic or alcohol—that are required and to be used for the manufacture of essential items.

▪ Fuel.

▪ Equipment, supplies and persons necessary to establish and manage temporary housing, quarantine.

▪ Persons designated by federal, state or local authorities for medical, isolation, or quarantine purposes.

▪ Persons necessary to provide other medical or emergency services.

FMCSA’s emergency declaration is the first time the Agency has issued nation-wide relief and follows President Trump issuing of a national emergency declaration in response to the virus.

Lt. Governor Husted announced that the Governor’s Office of Workforce Transformation has developed a website specifically geared toward matching essential businesses with Ohioans who are able and willing to work as an essential employee during the COVID-19 crisis. Click HERE to access the job search site.

Special COVID-19 Coverage Brought to You By:

![]()

![]()

Friends of OTA:

Marsh & McLennan Agency

J.J. Keller & Associates

Truck Renting & Leasing Association

Poster to Download and Display

Display this poster in your workplaces and distribute to your employees in an effort to dispel rumors and remind employees of the Social Distancing requirements set forth for in the stay at home order.

(right click on the image and select "Save Image As" to save and print or CLICK HERE to download)

On March 25 the Federal Motor Carrier Safety Administration (FMCSA) provided updated guidance to their Drug and Alcohol testing policy, which will remain in effect until May 30, 2020. CLICK HERE for a member-exclusive summary of the guidance and what you need to do to stay in compliance.

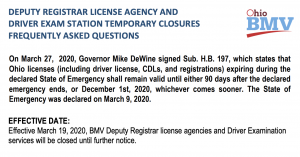

BMV Temporary Closure FAQs

On March 27, 2020, Governor Mike DeWine signed Sub. H.B. 197, which states that Ohio licenses (including driver license, CDLs, and registrations) expiring during the declared State of Emergency shall remain valid until either 90 days after the declared emergency ends, or December 1st, 2020, whichever comes sooner. The State of Emergency was declared on March 9, 2020. Read more HERE.

Summary of HB197

The Ohio Legislature and Governor's Office have worked together to ease regulatory burdens during this time. We are appreciative of the work being done by the state to ensure expiring CDL licenses continue to be valid and accepted until this historic time has passed. Read more HERE.

CDC Statement on Self-Quarantine Guidance for Greater New York City Transportation and Delivery Workers

When we issued the self-quarantining guidance for greater New York City residents leaving this area, it was out of an abundance of caution to help protect U.S. areas with lower levels of COVID-19 spread. In line with our recommendations for other essential critical infrastructure workers, this guidance does not apply to critical transportation and delivery workers who are desperately needed for New York residents to continue their daily lives and respond to the COVID-19 outbreak. Read more HERE.

CVSA Announces Postponement of Roadcheck Safety Blitz

The Commercial Vehicle Safety Alliance (CVSA) has announced the postponement of their annual nationwide Roadcheck Safety Blitz, scheduled for May 5-7, due to continued concerns over the COVID-19 Pandemic. The Roadcheck will take place at some point later in the year, although the specific dates have not yet been determined.

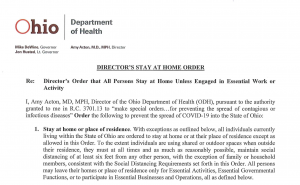

Ohio Issues Stay at Home Order

The Director of the Ohio Department of Health, Amy Acton, MD, MPH, has officially put in place a Stay at Home Order that will begin March 23 at 11:59 pm. The order requires all people to stay at home, except for individuals that are exempt based on the details of the order. Full details can be found HERE. Do you still have questions about the order? Find answers to the Frequently Asked Questions HERE.

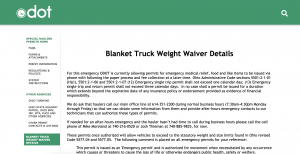

Ohio Overweight Permitting Information

For this emergency ODOT is currently allowing permits for emergency medical relief, food and like items to be issued via phone with following the paper process and fee collection at a later time. Ohio Administrative Code sections 5501:2-1-01 (H)(I), 5501:2-1-06 and 5501:2-1-07 (12) Emergency single trip permit shall not exceed one calendar day; (13) Emergency single trip and return permit shall not exceed three calendar days. In no case shall a permit be issued for a duration which extends beyond the expiration date of any insurance policy or endorsement provided as evidence of financial responsibility. Click Here for more information.

UPDATED: Ohio BMV Locations Remaining Open for CDL Exams and Renewals

Ohio Governor Mike DeWine announced that five BMV offices in Ohio will remain open for Commercial Drivers License (CDL) renewals and to perform commercial knowledge exams.

The locations to be opened are as follows:

Central Ohio: Registrar Office—4740 Cemetery Road, Columbus 43026 / Exam Station—4738 Cemetery Road, Hilliard 43026

NW Ohio: Registrar Office and Exam Station—1616 E. Wooster St., Bowling Green 43042

NE Ohio: Registrar Office — 7000 Biddulph Road, Brooklyn 44144

SW Ohio: Registrar Office—10938 Hamilton Ave., Mt. Healthy 45231 and Exam Station—10940 Hamilton Ave., Mt. Healthy 45231

SE Ohio: Registrar Office and Exam Station—142 Gross St., Marietta 45750

For the full declaration: BMV Closures Press Release

*note: as of March 23, the Registrar Office and Exam Station in Bedford is CLOSED.

UPDATED: PA Turnpike Reopens Service Centers

The Pennsylvania Turnpike Authority announced the reopening of restrooms and food carry-out options at the 17 Service Plazas along the Turnpike, starting Friday morning at 7:00 am.

Restrooms will be open 24 hours a day, while the food available for carry-out will be available from 7 am until 6 pm, except at the North Midway and Valley Forge plazas, which will offer food 24 hours a day.

Tolls will continue to be collected exclusively with EZ-Pass, or, for those vehicles that don’t have EZ-Pass, a Toll-by-Plate billing method will be used. The standard tolling rates will apply, with no surcharges added. Inquiries and further updates can be found at the Turnpike website.

Click HERE for more information.

Ohio Bureau of Workers Compensation Deferral

Ohio’s Bureau of Workers' Compensation (BWC) system is the exclusive provider of workers’ compensation insurance in Ohio and serves 249,000 public and private employers.

To help businesses facing difficulties due to the COVID-19 pandemic, the Ohio BWC is announcing that insurance premium installment payments due for March, April, and May for the current policy year may be deferred until June 1, 2020. At that time the matter will be reconsidered.

"BWC will not cancel coverage or assess penalties for amounts not paid because of the coronavirus pandemic," said Lt. Governor Husted. "Installment payments due for the three-month period are totaled at approximately $200 million, and that money will now stay in the economy."

For more information, visit www.bwc.ohio.gov.

DoD Suspends All Military Moves

All DoD military personnel will stop movement while this memorandum is in effect. In addition, DoD civilian personnel and DoD family members, whose transportation is government-funded, will also stop movement. This policy applies to Permanent Change of Station (PCS) and Temporary Duty. Click HERE.

Grace Period for Health Insurance Premiums

All health insurers are required to provide the option of deferring premium payments, interest free, for up to 60 calendar days from each original premium due date. This means that employers can defer their premium payments up to two months, giving them some relief on costs, while keeping their employees insured. Read details HERE.

Federal IRS Tax Day now July 15

Businesses who need additional time must file Form 7004

IR-2020-58, March 21, 2020

WASHINGTON — The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020.

Taxpayers can also defer federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax.

Taxpayers do not need to file any additional forms or call the IRS to qualify for this automatic federal tax filing and payment relief. Individual taxpayers who need additional time to file beyond the July 15 deadline, can request a filing extension by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004.

CLICK HERE for full news release. CLICK HERE for IRS Coronavirus Tax Relief Page.

Ohio Chamber of Commerce Resource Page

As a resource for you, the Ohio Chamber of Commerce has launched COVID-19 Business Resources webpage. The new webpage is designed to be a central hub for Ohio business owners to view current temporary restrictions, available resources to help curb the COVID-19 impact on your business, and pending legislation addressing COVID-19 and aiming to provide additional relief to businesses. Click HERE for the resource page.

Pilot Flying J Updates Which Centers are Open Around the Country

A note from Pilot Flying J: Thank you and your drivers for continuing to deliver the goods we need, especially in challenging times when they are needed most. We are here to serve you and keep you moving. Our number one priority is protecting the safety of our team members and guests. We developed a response task force in February to monitor COVID-19 (coronavirus) and have been meeting daily to monitor and update our plans to best respond to the rapidly changing situation. Click HERE for full list of services.

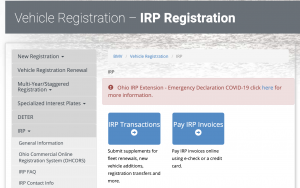

IRP Extension

Governor DeWine has declared a state of emergency, so until further notice all International Registration Plan (IRP) jurisdictions and enforcement personnel will refrain from taking enforcement action on vehicles barring Ohio IRP Vehicle Registrations (IRP Cab Card or IRP Temporary Authorization Authority [TA]) that have expiration dates on or after March 18, 2020. We recommend you print off and carry the letter with you. Click HERE for more information and the letter.

U.S. Small Business Administration Relief

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Click HERE for more information.

Governor DeWine Issues Unemployment Declaration

An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohio's emergency declaration period. Unemployment benefits will be available for eligible individuals who are requested by a medical professional, local health authority, or employer to be isolated or quarantined as a consequence of COVID-19, even if they are not actually diagnosed with COVID-19. In addition, the waiting period for eligible Ohioans to receive unemployment benefits will be waived. Click HERE for more information.

For the latest information regarding COVID-19 in Ohio go HERE.